pic: rawpixel

Dear son,

IPO base is a wonderful technical analysis paradigm. Often in good IPOs retail investors do not get allocation. And even if you get allocation, it will be a miniscule amount, not big enough to make a difference.

IPO base, originally coined by Willem O’Neil, offers a method by which we can get into good stocks in a rule based manner in large quantities.

This post is not about rules, rather a side that I see a lot of people neglecting while trading IPO base - Fundamentals.

Yeah I know technicals blah blah - Let me give an example.

A friend was heavily long in a company called CAMPUS - a very good example of IPO base.

Fundamentally, unlike all the personal segment IPOs last year, this is a good one with

very good product mix and range.

While reviewing the stock, I came across a number P/E = 250.

Voila! Nike, the biggest player in this sector has a P/E of 20.

What does 250 P/E mean one might wonder - simply put it means that the company is goign to take 250 years to return your investment :-)

Well such valuations are common for unicorns, CAMPUS is exploding the market.

Well I could counter that in a million different ways, I am not going to attempt it.

Once a brand is known for its ‘cheapness’ it is very difficult for the brand to succeed in premium market. 24% of footwear segment is premium.

There is huge competition at bottom of the pyramid with BATA, Relaxo et al.

Just by spending on marketing, you can only increase the value so much.

Walk into a Nike show room, ask the sales person or store manager to reccommend a pair of shoes. You will be given all scientific and technical details, and how those shoes are the ones Nike specially crafted with you in mind.

Other aspect is the number of fakes out there. Nike spends huge R&D on detection of fakes. with campus AI, I think they might be moving in that direction as well, which is good sign.

Indeed. market loves such companies. the catch is they need to deliver quarter over quarter of good earnings.

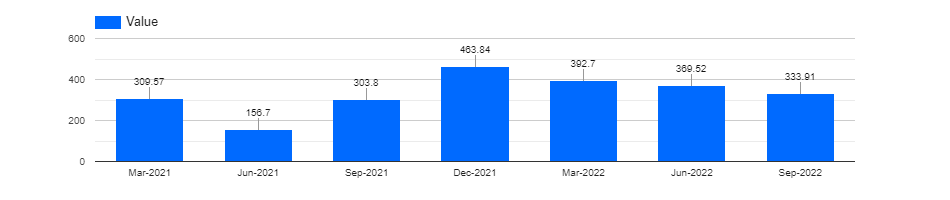

Let’s us take a look at earnings

For this company to trade at such hefty valuations, it must make PAT of 42% YOY till 2025. Is that achievable? May be. Only time will tell.

Now let us take a look at stock chart and see what happened/might happen

As commonsense was suggesting, stock is a whopping 25% down.

I wouldnt be surprised if stock finds it way to 360 levels.

Son, the point is when you make any significant decision, consider multiple parameters.

A little common sense is all it takes isnt it buddy?

Photo by Greg Bakker on Unsplash

Luv

your dad